Digital assets services providers (DASP) authorisation : Q&A from the French Financial Market Authority

Nearly a year after the introduction of the regime governing digital asset service providers, the Autorité des marchés financiers (“AMF”) issued on Tuesday 22 September 2020 a Q&A on the DASP regime under French law.

This communication addresses several doubts and uncertainties raised by stakeholders in the ongoing proceedings regarding both the scope and the conditions of registration required for companies selling or holding digital assets.

Clarifications on the scope of the DASP regime

The highly innovative and transnational nature of services based on digital assets led the AMF to clarify the material scope as well as the territorial coverage of the regime. Besides, the regulator recalled the wide scope of the digital assets’ custodian activity.

The material scope of the DASP regime

Regarding the material scope, the AMF defined the notion of digital assets concerning the growth of stablecoins. Also, the regulator considers that the regime for intermediation in miscellaneous assets was still likely to apply.

The notion of digital assets. – The AMF’s position confirms the European Banking Authority position have already hinted: a digital asset qualification is independent of e-money. It thus removes a source of regulatory overlap for digital assets attached to legal tender that may fall under either of the following two definitions:

- an e-money within the meaning of Article L. 315-1 of the Monetary and Financial Code defined as “a monetary value that is stored in electronic form (…) representing a claim on the issuer, that is issued against the remittance of funds for payment transactions (…) and that is accepted by a natural or legal person other than the issuer of electronic money” and ;

- that of a digital asset within the meaning of Article L. 54-10-1 of the same code defined as the “digital representation of a value which is not issued or guaranteed by a central bank or a public authority, which is not necessarily attached to a legal tender and which does not have the legal status of a currency, but which is accepted by natural or legal persons as a means of exchange and which can be transferred, stored or exchanged electronically”.

Thus, stablecoin whose rate is pegged to a fiat currency (euros or dollars) will fall outside the scope of digital assets only when qualified as e-money (i.e. when they constitute a claim on the issuer for instance). It is worth bearing in mind that the e-money regime is much more restrictive than the DASP’s one.

The regime of the intermediation in miscellaneous goods (“IBD regime”). The AMF also confirms that a digital asset can be a miscellaneous good within the meaning of the IDB regime. The market watchdog considers that this regime, provided for in Articles L. 551-1 of the Monetary and Financial Code, is likely to apply over and above the digital services’ regime, provided that the conditions are met (i.e. a public offering of miscellaneous goods with a return or with third-party management).

This approach seems especially severe given that this subsidiary regime only applies in the absence of more specific regulation. The AMF Sanction Commission frequently refers to this subsidiary nature on its decisions. However, unlike the token issuance regime, the digital asset services regime does not expressly reserve the application of the IBD regime.

The territorial scope of the DASP regime

Regarding the territorial scope of application, one of the main questions about the DASP regime was its application to the many foreign actors who directly or passively carry out their activity towards the French public (Coinbase, Binance, Kraken or BitPanda for instance).

On this issue, the AMF recalls the usual criteria for an online service provider located abroad to be subject to French law. Apart from the obvious situations such as the presence of premises on French territory, the installation of Bitcoin ATMs – as it is currently – or the use of a French retailer, the AMF’s position states that a “.fr” domain name or promotional communication is enough to link the service provider to the French DASP regime.

The term “promotional communication” refers to any form of advertising targeting the French public or residents of France: advertising in French media, ads targeted at French people (Facebook, Twitter or Instagram), advertising at events in France (e.g. the Blockchain Week or EthCC) or an affiliation campaigns aimed at the French public.

However, French language or the acceptance of the euro, both of which exceed French territory, are not regarded – on their own – as allowing a link to the DASP French regime.

Finally, foreign service providers who have a website in French, accept the euro but do not target the French public are not required to register.

The scope of the custody of the digital assets under French law

Oddly, the notion of digital asset custody is based on a purely technological concept: the control over the private keys. The AMF recalls that there are no exceptions to this principle. Indeed, if the service provider is able, on behalf of its client, to “transfer the digital assets; keep the private keys in its wallet; register the digital assets on a blockchain address under its name or receive the digital assets in its wallet” then the activity is subject to the DASP French regime.

In the AMF’s opinion, even multi-signature mechanisms do not exclude DASP qualification, given that the custodian is in a contractual relationship with its client. However, this clarification seems inconsistent with the criteria set out in the same position. Indeed, the service provider is not able to move digital assets without its client technical approval.

Thus, all services that offer custody of digital assets (token or crypto) to French users or from France are required to register as a DASP. The only exception: providing a technological solution ensuring custody under the exclusive responsibility of the customer (i.e. a non-custodial wallet). Accordingly, the DASP regime follows the adage “not your key, not your bitcoin” to draw the limit of its scope of application

Details on the requirements to obtain DASP registration

Regarding the conditions to obtain registration, the AMF warns DASP of the deadline by which they will no longer be able to operate if not registered as well as of the risk of providing payment services to those offering the purchase and sale of digital assets.

Registration: 12-month deadline for already established actors

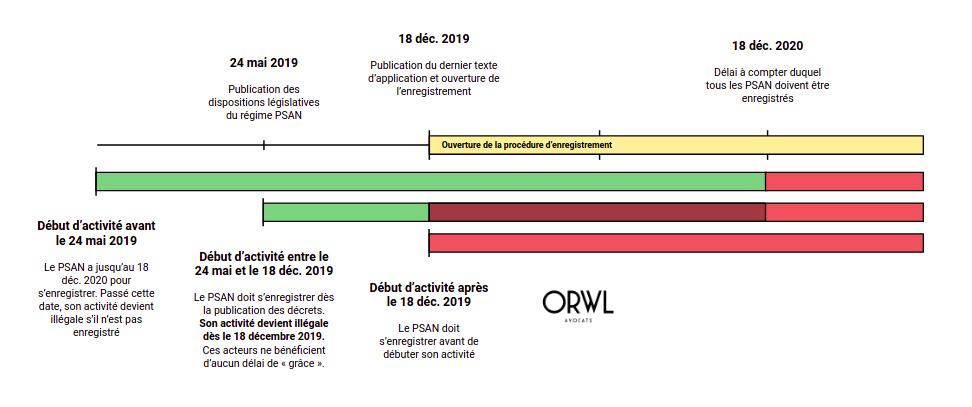

DASP that launched their business before the new regime came into force have a 12-month deadline to register with the AMF (Art. 86, X, Act 2019-486 of 22 May 2019, PACTE).

The issue lies in determining the date of “entry into force of the regime” since the PACTE Act was adopted on 26 May 2019 but could not come into force until after the publication of the implementation provisions on 19 December 2019.

The AMF explains quite inconsistently that only DASP operating before the date of publication of the law can benefit from this grace period.

But this period does not start until the date of publication of the implementing decrees… It is worth remembering that the first article of the Civil Code provides that rules whose fulfilment involves implementing measures come into force from the date of publication of the latter.

Consequently, the DASP that started their activity between 26 May 2019 and 19 December 2019 is prevented from being registered and in breach of the regulation.

The notion of payment collection on behalf of third parties under French law

Under a position of January 2014, the banking regulator (”ACPR”) stated that “the intermediation activity of receiving funds from the buyer of Bitcoins and transferring them to the seller of Bitcoins falls within the provision of payment services.”

To reach this finding, the ACPR relied on the notion of collection on behalf of third parties – which is strongly disputed by the doctrine – that merges two payment services: the acquisition of payment orders and the execution of transfer orders in connection with a payment account.

Accordingly, this regulator considers that a DASP providing a buy-sell service for digital assets and sourcing on a just-in-time basis – after each order – provides a payment service. The compliance with this strongly disputed position on payment services is a requirement to obtain AMF registration as a digital asset service provider.

In other words, it is prohibited to sell bitcoins acquired concomitantly from a third party (an exchange platform or a broker) without a payment institution licence.

Factually, the affected DASP will have to change their business model as no payment service provider (PSP) currently offers payment collection for third party.