Digital Assets Service Providers: the new legal conditions to enter the French market

After Malta, France is the first country to adopt a legal framework dedicated to digital assets service providers. All Digital Assets Service Providers (DASPs) targeting the French market will be affected.

DASPs operating currently will have 12 months to comply.

While this regime is attractive, it requires the implementation of a number of measures in order to continue to benefit from the French market.

However, compliance with these rules also presents interesting opportunities to benefit from legal certainty and safe access to almost the entire European market.

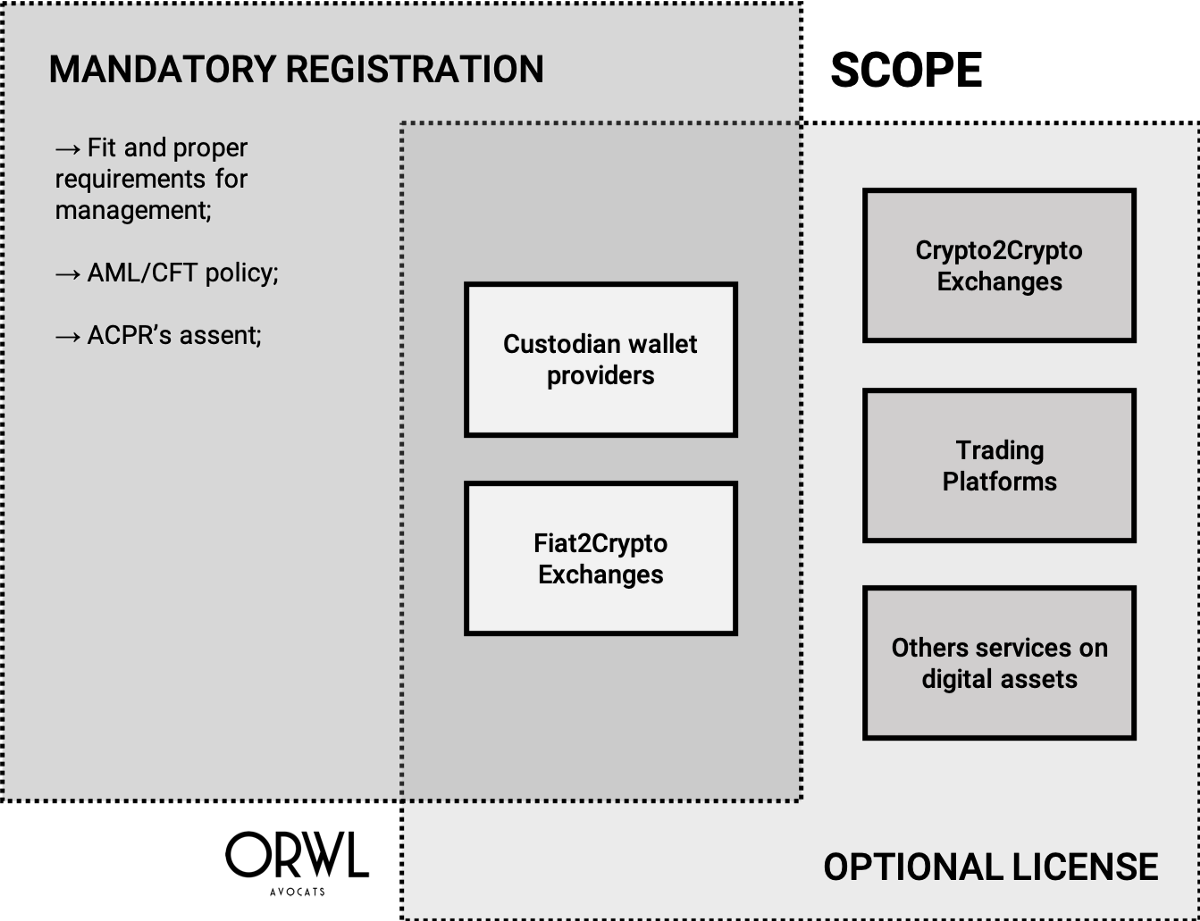

1. Which DASPs are affected?

However, compliance with these rules also presents interesting opportunities to benefit from legal certainty and safe access to almost the entire European market.

The regime adopted in France applies to companies carrying out one of these activities:

- custodian wallet providers;

- crypto2fiat exchanges;

- crypto2crypto exchanges;

- trading platforms;

- DeFi/trading platform;

- management of digital asset portfolios on behalf of third parties;

- investment consulting;

- broker.

2. How to register your activity ?

Mandatory registration has to be done with the French Market Authority which controls the following conditions:

- Fit and proper requirements for management;

- Compliance with anti-money laundering obligations; this implies in particular a AML/CFT policy and a risk identification process.

The procedure may not take more than 6 months from the date of submission of the complete application to the AMF. Unregistered exchanges and custodians will be prohibited from exercising in France. In addition, their managers will be liable to 2 years’ imprisonment and a fine of €30,000 and the DASP website may be subject to administrative blocking.

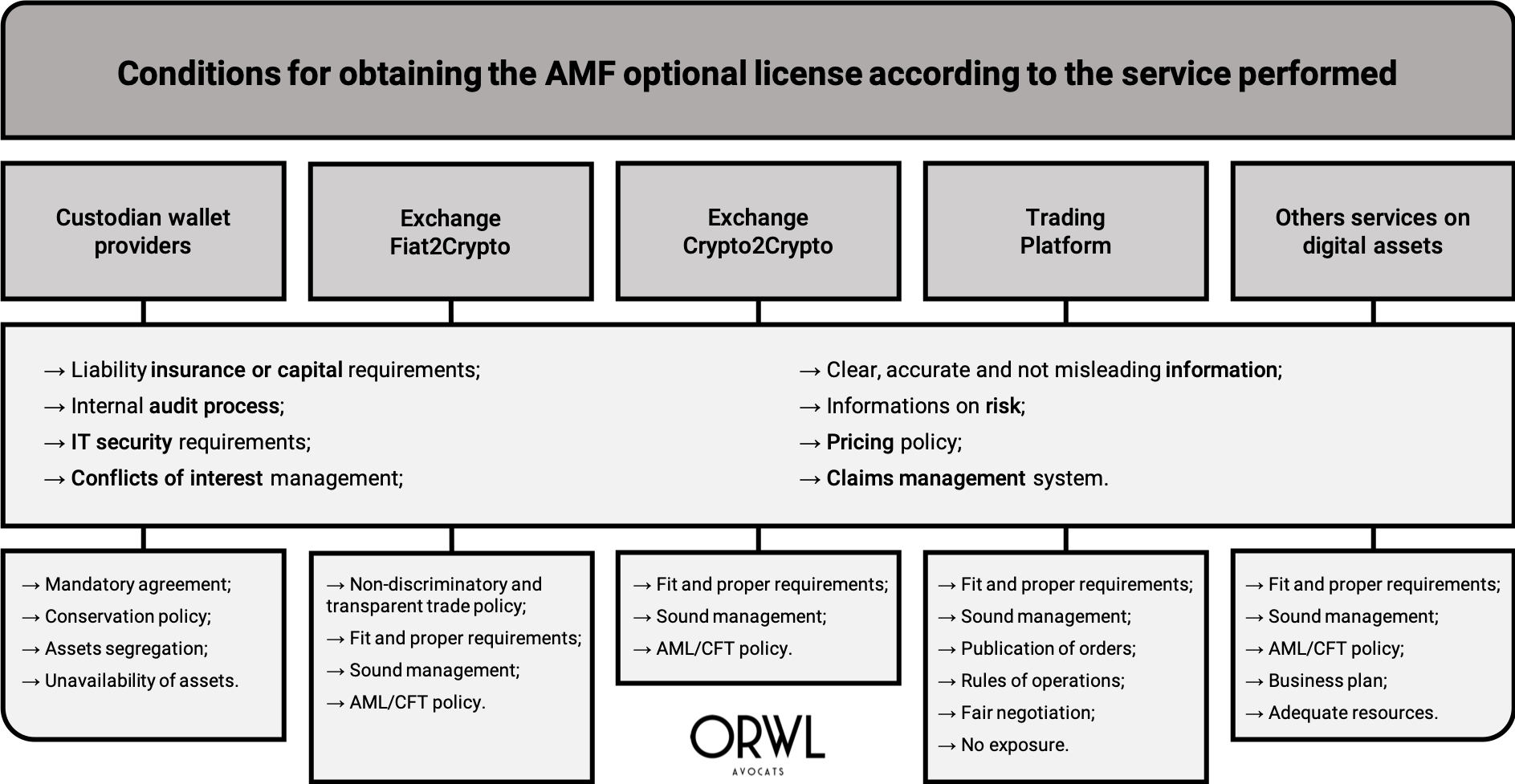

3. How to obtain the optional license ?

To obtain the license, operators must comply with several obligations:

- be established in France (ie. a company incorporated in France);

have professional liability insurance (€400,000 per claim and €800,000 per year) or capital requirement of at least €50,000 (non-custodian) to €150,000 (custodian); - have an internal auditing process;

- have a strong computer system;

- provide conflicts of interest management rules;

- provide their customers with clear, accurate and not misleading information;

- warn their clients about the risks associated with digital assets;

- make their pricing policies public;

- implement an effective claims management policy.

Custodian wallet providers should also:

- sign an agreement with their customers defining their liabilities;

- define a custodian wallet policy;

- segregate holding on behalf of clients and refrain from using their customers’ digital assets.

Exchanges will also have to:

- publish the prices of digital assets sold and the volumes of transactions executed;

- define a programme of activities and demonstrate that they have the means to implement it.

Finally, the managers and beneficial owners of the DASPs will be subject to a fit and proper requirements for management check and accredited service providers will be subject to AML/CFT policy.

The AMF license application procedure may not exceed six months from the date on which the application is fully submitted to the AMF.

4. Why should the optional license be requested?

To encourage DASPs to apply for it, obtaining the AMF optional license offers economic and legal advantages. Thus, licensed DASPs benefit from :

- entry on the white list published by the AMF, which could represent a competitive advantage in terms of user confidence;

- significant legal certainty in France and the EU;

- access to banking services to facilitate the opening of a bank account in France;

- possibility to communicate without constraints.

DASPs that do not have the licence may still operate.

However, their communication ability will be limited since they will not be able to carry out direct selling or sponsorship actions in order to promote their activity.

Therefore, compliance involves a careful drafting of several information documents and the implementation of legal and administrative procedures.

ORWL avocats law firm is at your disposal to assist you in these procedure or to provide you with more information.