DASP: How to address the French market from abroad ?

On 18 December 2020, the legal framework governing digital asset service providers (DASPs) adopted by the PACTE law will come fully into force in France.

The French regime applies to companies providing one of the digital asset services defined by the legislator: 1° custody; 2° buy-sell of digital assets in legal tender; 3° swaps between digital assets; 4° operation of a trading platform; 5° other services ( reception and transmission of orders; portfolio management, financial advice, etc.).

The framework introduces a mandatory registration for the first two services as well as an optional license for all services.

The French framework is applicable to foreign DASPs targeting the French market. In this case, these players are required to be registered with the AMF prior to providing the first two services and can also use this opportunity to apply for a license without having to relocate their activities to France.

🎯 What does targeting the French market mean ?

Pursuant to the French Financial Markets Authority’s (AMF) clarifications, a foreign DASP is deemed to be targeting the French market when one of the following indices is identified:

- a physical installation in France such as commercial premises, cryptos ATMs, etc.; ⛺️

- communication targeting the French market via the press, the radio, but also on the Internet and, in particular, on social networks, whether it be invitations to events, targeted advertising, affiliation campaigns, retargeting advertising, etc.; 📣

- a postal address, telephone details in France or simply a .fr domain name. 📫

Foreign DASPs wishing to actively address the French market, for example by using the services of French influencers, partnerships with French media or by deploying material and human resources in France, will be required to register with the AMF before offering buy-sell or custody services for digital assets.

👮 How to be authorised to target the French market from abroad ?

Under the registration procedure, the regulator verifies the good repute and competence of the service provider’s managers and major shareholders, as well as the adequacy of the AML/CFT system.

Although DASPs must register before they can provide services in France, they are not required to relocate all of their operations to France.

Indeed, as part of the registration procedure, there is no legal requirement to be established in France. However, the AMF has specified that DASPs must, at the very least, be established in a Member State of the EU or the European Economic Area (🇮🇸, 🇳🇴, 🇨🇭, 🇱🇮), the fate of the United Kingdom being in doubt until 31 December 2020.

The notion of establishment is not defined by law. According to the AMF’s clarifications, the main requirement for registration is to have an address and a representative in one of the above-mentioned countries who would be responsible for enforcing the AML/CFT system in France.

A branch or subsidiary with no permanent staff should therefore be sufficient for the purposes of the registration procedure.

Nothing then prohibits the provision of digital asset services from another entity of the group located outside the EU or the EEE.

🎖 How to get licensed by the AMF without relocating operations ?

While registration allows foreign DASPs to legally target the French market, the purpose of the license is, for all types of services on digital assets, to guarantee to the public the quality, reliability and transparency of the service provider.

The procedure is more demanding since the regulator verifies that the provider meets a series of criteria, including financial safeguards (insurance or equity capital), a transparent pricing policy, etc. In return, this license provides a clear advantage for the DASPs.

On the one hand, it allows the use of communication tools that enable faster business development on the 🇫🇷 market : licensed DASPs can carry out direct marketing operations (mailings, etc.) but also sponsoring or patronage operations for public events or sports teams, for example.

On the other hand, it gives the licensed DASPs a considerable edge over future European regulation. Indeed, the European Commission’s proposed regulation is strongly inspired by the French DASP license. Above all, it stipulates that DASPs already licensed under national law will benefit from a simplified procedure and will not have to submit information and documents already requested at the time of their national registration in order to benefit from European approval.

In other words, DASPs licensed in France will be able to extend their license to operate throughout the European Union after a few simple formalities.

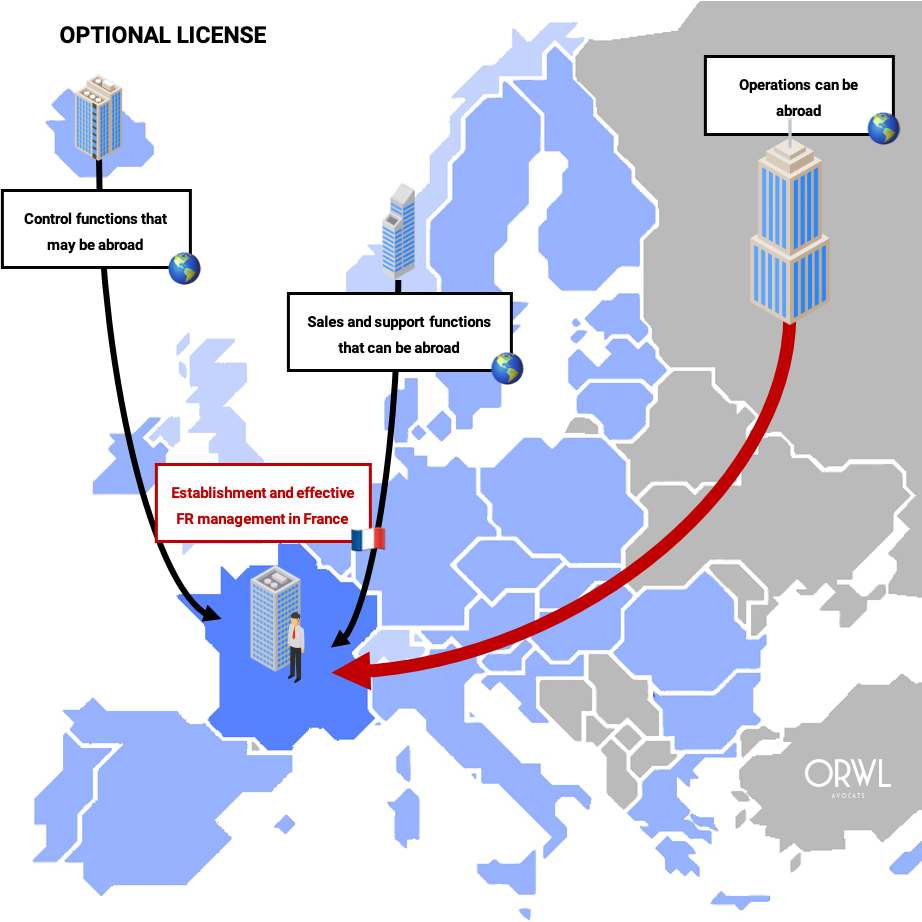

Foreign DASPs can obtain a license in France without disrupting the structure and the organisation of their group. Three main requirements are expected from service providers in terms of location of resources and operations.

Firstly, the licensed entity must be established in France in the form of a subsidiary or branch and the effective management of French activities must be physically present in France. The AMF verifies that the entity is more than just a mailbox. 📮

Secondly, the entity must demonstrate that a sufficient number of employees perform, for France, the commercial, control and support functions. However, these employees do not necessarily have to be established in France and may work in another entity of the group. 🌏

Lastly, services on digital assets may still be provided by a DASP’s entity based outside France, but the AMF requires, in this case, that a relatively precise outsourcing contract be concluded between the licensed French entity and the foreign DASPs’s operating entity. 📕

Finally, in addition to the size and quality of the crypto community in France, the French DASP regime is a gateway to the European market that may appropriately fit into the European development strategy of American and Asian market players.

ORWL Avocats is at your disposal to discuss this subject and to assist you in the design and the implementation of a compliance strategy in France and in Europe.