DASPs : How to challenge a decision of the regulator?

One of the consequences of the progressive institutionalisation of the crypto sector is its increasing interaction with financial regulators, which can sometimes result in binding decisions that players may decide to challenge in court.

For example, in three orders issued on 14 April 2021, the Paris Court of Appeal suspended decisions by which the Autorité des marchés financiers (AMF) had ordered digital asset service providers (DASPs) to cease their activities as they had not been registered.

In a similar perspective, on 15 April 2021, the French financial regulator added one of the world’s largest digital asset exchanges crypto.com on the blacklist of unregistered operators after a prior warning from the AMF.

The preferred approach for a player facing opposition from the financial regulator, whatever its type (i.e refusal of registration, formal notice, financial sanction, blacklisting, disagreement on the applicable regulatory regime, etc.), should be to negotiate in view of an amicable resolution. Litigation is intended to remain a last resort, to be used only if negotiations fail. A failure to negotiate may be due to an irreconcilable difference of opinion or an emergency situationlikely to cause significant damage to the image or economic situation of the company.

Before discussing how to challenge an AMF or ACPR decision in court, we will briefly review the potential sanctions to which players considered to be in breach of the regulations are exposed to.

🏦 The players concerned

Before briefly reviewing the sanctions applicable to non-registered DASPs in France, we would like to pay particular attention to the issue of the AMF’s jurisdiction to sanction a platform, since the regulator’s jurisdiction to act is limited both materially and territorially.

In theory, the AMF can only act against players established on French territory or foreign players considered to be targeting the French market.

This last notion has been clarified by the regulator, which intends to take action, for example, by using the services of French influencers, partnerships with French media or by deploying material and human resources in France.

👮 A wide range of potential sanctions

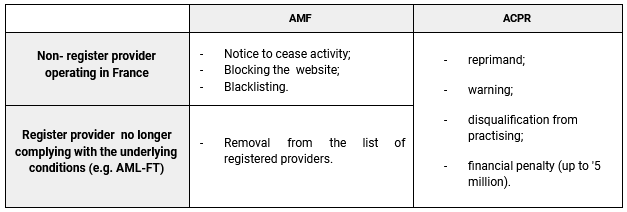

DASPs that are subject to mandatory registration may be administratively sanctioned by the AMF or the ACPR in the following main scenarios:

These sanctions may be accompanied by criminal proceedings against de jure or de facto managers of the services concerned.

Moreover, the duality of the regulatory authorities and the plurality of the types of sanctions that may be imposed on the players make the litigation procedure particularly complex and trapping.

🚧 Complex time limits for appeals

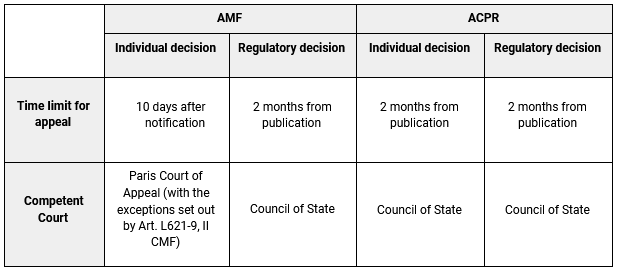

Depending on the authority that issued the sanction (AMF or ACPR) and the nature of the sanction imposed, the time limit for appealing may be extremely short.

It is therefore the responsibility of the players to be particularly reactive when faced with an unfavourable decision by the financial regulator. They also should assess very quickly the appropriate recourse and the related deadlines, otherwise they will be precluded from taking legal action.

This need for responsiveness is even more important given that appeals against financial regulators’ decisions are governed by complex and multiple procedures.

Thus, challenging individual decisions taken by the financial regulator is subject to a single ad hoc procedure set out in the Monetary and Financial Code, which is subject to particularly strict formalities that regularly result in decisions rejecting appeals from players.

🚪 The competent court

One of the most delicate issues in regulatory litigation is which competent court should be chosen when taking an action against an AMF or ACPR decision. In a very schematic way, its choice will depend on the author and the nature of the decision to be challenged.

In addition to this schematic division of competences, there are two other difficulties: the subtle distinction between individual and general decisions, and the impossibility of appealing against a general decision if it is not considered sufficiently prejudicial to the player.

It is therefore up to the players contemplating a legal remedy to examine each of these points in order not to run the risk having their recourse declared inadmissible.

🚨 Emergency procedure

When the consequences of the regulator’s decision appear to be manifestly excessive or endanger the economic survival of the player, the regulator may have recourse to emergency procedures before the Paris Court of Appeal and before the Council of State.

This procedural option was successfully used by three digital asset service providers that challenged the AMF’s decisions ordering them to suspend their activities.

In three orders dated 7 April 2021, the Paris Court of Appeal granted their request, suspending the decisions pending a judgment on the merits of the case and allowing the players to continue operating.

The AMF based its decision not only on the manifestly excessive consequences of the injunction to cease operations for the players concerned, but also on the manifest illegality of the sanctioning procedure.

ORWL Avocats law firm remains at your disposal to provide you with further information or to assist you in this process.