Cryptocurrencies : a guide to tax auditing

As soon as the tax system has been clarified, holders and users of cryptocurrencies are already confronted with tax audits.

On 2 September 2019, in its administrative comments on the new tax regime for capital gains from the sale of digital assets, the administration reminded that capital gains realised in 2018 could still be subject to adjustments.

While the taxation of cryptos has raised many questions and experienced major changes, the framework is slowly beginning to stabilise for both individuals and companies:

- for individuals: a new regime is now applicable (more information here); it provides in particular for taxation at the time of the exit of digital assets from the portfolio against a fiat currency or at the time of the purchase of a good or service (crypto-crypto transactions are neutralised); the overall capital gain for the year is taxed at a flat rate of 30%;

- for companies: the methods for accounting for digital assets are beginning to become clearer; with regard to issuance, the Accounting Standards Authority has published very precise regulations; with regard to mining, the tax authorities have published information from which certain keys to analysis can be drawn; finally, a rescript on the VAT treatment of ICOs provides guidance in determining whether transactions involving digital assets should be taxed.

Questions of law remain, but the framework is now sufficiently clear for the administration to make adjustments that already concern many individuals and businesses.

* * *

For the time being, several factors are likely to increase the risk of undergoing such controls.

First, the exercise of an activity related to digital assets. We are thinking of what the PACTE law designates as digital assets service providers such as exchange platforms, wallet providers, investment advisors, etc. But also mining companies of all sizes.

Secondly, the use of regulated exchange platforms. Exchanges located in OECD Member States or having signed an automatic information exchange convention with France may indeed be required to transmit the information they hold on their users to their respective administrations, which may then communicate it to the French tax authorities. Platforms located in France, the United States, the United Kingdom, Australia, Japan and Canada have already been requested to do so.

Finally, transfers in fiat currency made between an exchange platform and its bank account. Banks are also likely to be subject to a request for their customers’ bank statements from the tax authorities that could draw attention to cryptocurrencies-related activities. Large deposits or withdrawals may also lead the bank to spontaneously transmit the information to Tracfin, which may, in some cases, forward it to the tax authorities.

As the legislation is new and digital assets have very specific characteristics, we suggest that you review the course of the control procedure and the room for manoeuvre for a proper defence.

* * *

The conduct of a tax audit related to cryptocurrencies

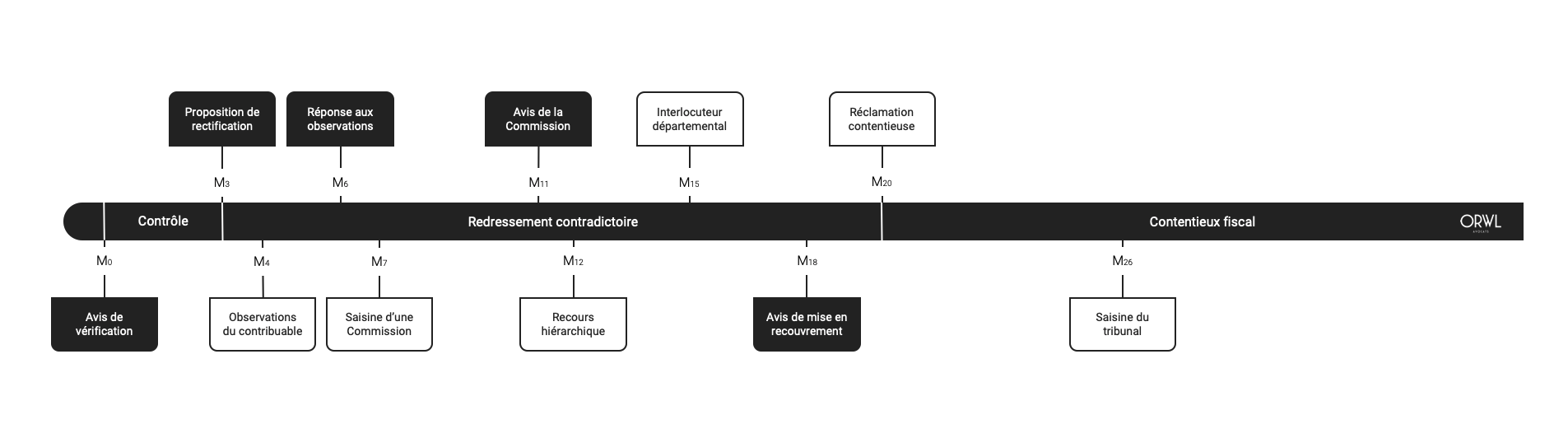

Tax auditing can take very different forms. Given the difficulties that digital assets present both in terms of access to evidence and in terms of analysis of flows and transactions, it is more likely that the adversarial procedure will be implemented against both companies and individuals. The procedure may last several years from the beginning of the audit to the exhaustion of the means of appeal. It is therefore important to be fully aware of the various decisive stages.

The control phase

The procedure varies significantly depending on whether it concerns a company or an individual. In most cases, it is a so-called adversarial procedure in that it allows a debate between the inspector and the taxpayer being inspected. It begins with the sending of an audit notice.

The inspector may then go to the business premises or receive the taxpayer to discuss the elements that may be subject to an adjustment. Corporate accounting is subject to a consistency check and the income declared by individuals is compared with the flows received on their bank accounts or exchange platforms, for example. In the context of a tax audit related to cryptocurrencies, the difficulty of the operations should lead to the rejection of a documentary audit.

The contradictory assessment of additional tax

At the end of the control operations, the inspector sends the taxpayer a proposition de rectification, i.e. a letter in which the adjustments are notified and legally justified.

A period of contradictory discussion is then set up, often within fairly short deadlines, the lack of knowledge of which may be detrimental to the taxpayer.

In addition to the possibility of contesting the rectification proposal, the taxpayer has the right to refer the matter to the commissions giving an opinion on the appropriateness of the rectification, but also to the inspector’s superior or to a departmental interlocutor.

Although these appeals rarely succeed, they offer the possibility of building up the taxpayer’s arguments with a view to legal action.

Once these appeals have been exhausted, the tax authorities may then put the reassessed taxes into collection.

The litigation phase

Upon receipt of the notice of collection, the taxpayer has two months to contest it by sending a contentious claim. The complaint allows the taxpayer to benefit from a tax deferment until the end of the litigation procedure.

In the absence of a response from the administration within 6 months or within 2 months from the response, the taxpayer may file a petition with the administrative court to obtain a discharge of the contested taxes.

In the event of an unfavourable decision, it is then possible to appeal and then, in the event of a new failure, to appeal to the Conseil d’Etat.

During all stages of this lengthy procedure, it is advisable to be particularly vigilant with regard to its regularity and deadlines, but also to transmit useful information and propose relevant arguments.

* * *

Arguments to be raised in the context of a tax audit related to cryptocurrencies

Both during the review and after the notification of tax adjustment, the assistance of a lawyer with technical knowledge of digital assets may be necessary.

On the one hand, to avoid self-incrimination and to facilitate dialogue with the administration on a particularly new and complex subject.

On the other hand, to control the regularity of the procedure and to present the arguments likely to lead to the abandonment of the tax adjustment.

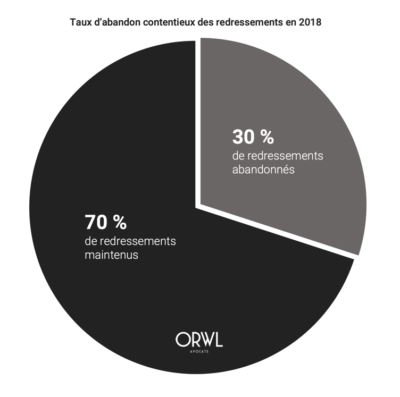

The DGFiP’s annual report for 2018 states in this respect that 30% of the adjustments contested by taxpayers are finally abandoned by the tax authorities spontaneously, not counting those that are successful before the courts.

Several areas for negotiation and discussion can be developed in the context of control operations, the contradictory reassessment phase or the litigation phase.

Classification as an occasional activity

With regard to private individuals, the debate following a tax audit related to cryptocurrencies is mainly likely to focus on the qualification of the activity. Gains from an occasional activity are taxed at a flat rate of 36.2% in 2018 and 30% from 2019 onwards. The reclassification of the activity as usual would result in these earnings being subject to the progressive scale of income tax at rates of up to 62.5% depending on the level of income. In addition, much less favourable methods for determining the tax base would have to be applied (in particular, for 2018, no deduction for disposals of less than €5,000).

However, the debate on this qualification which should be established with the administration would present the difficulty of having to be particularly detailed but also very legal:

- on the one hand, a lot of pedagogy should be done on the characteristics of digital assets to explain certain circumstances that could be used to establish the usual character (i.e. highlighting the particularly liquid nature of cryptos and the ease of access to exchange platforms explaining a large number of orders) ;

- on the other hand, it would be necessary to deploy a genuine legal argument based on the analysis of case law in an attempt to shift the traditional criteria for assessing habituality (amount, frequency, number of transactions) to more appropriate criteria such as in the case of stock exchange transactions.

* * *

Determining the taxable base

For both individuals and companies, the discussion will then be particularly complex with regard to the tax base.

The starting point of the discussion will naturally be the information available to the administration, which may sometimes work to the disadvantage of taxpayers.

It will therefore initially be necessary to be particularly vigilant with regard to the nature of the documents spontaneously communicated to the administration.

Next, taxpayers will have to be pedagogical in presenting the information available to the administration. Indeed, credit movements on the bank account coming from exchanges will have to be explained to avoid them being considered as gains in full. The data from exchanges will also have to be explained to highlight the deductibility of transaction costs and to prevent a single order, executed on the platform in several transactions, from being considered as several orders (which would reinforce the qualification of usual activity).

For companies, the mining activity would, for example, present difficulties for the administration, which could ultimately be detrimental to the taxpayer. The first, in terms of corporation tax, would lie in the distinction between the proceeds from the mining activity and the proceeds from the sale of the mined cryptos. The second, in terms of VAT, would lie in the determination, according to the nature of the operations, of the taxable status (exchanges between cryptos not being taxable) and the tax base.

* * *

Negotiation of penalties

Finally, at the end of the control phase, the administration could, depending on the case, be tempted to apply penalties of 40% for deliberate failure to comply, or even 80% in the case of fraudulent manoeuvres.

In the first case, taxpayers will be able to negotiate fairly easily to waive these significant penalties by highlighting the legal uncertainty that has weighed – and often still weighs – on digital asset transactions and by insisting on their good faith.

The abandonment of these penalties, which are almost systematically applied by the administration, represents a major saving for the taxpayer.

* * *

ORWL Avocats is at your disposal to provide you with further information and to assist you in the context of audit operations or in the event of tax disputes.