#1 🤝 Loans – Legal and tax issues of DeFi

As with traditional finance (TradFi), credit is at the root of decentralised finance (DeFi). It is therefore quite natural that we begin our series of legal and fiscal analysis of the sector with decentralised lending applications (lending dapps).

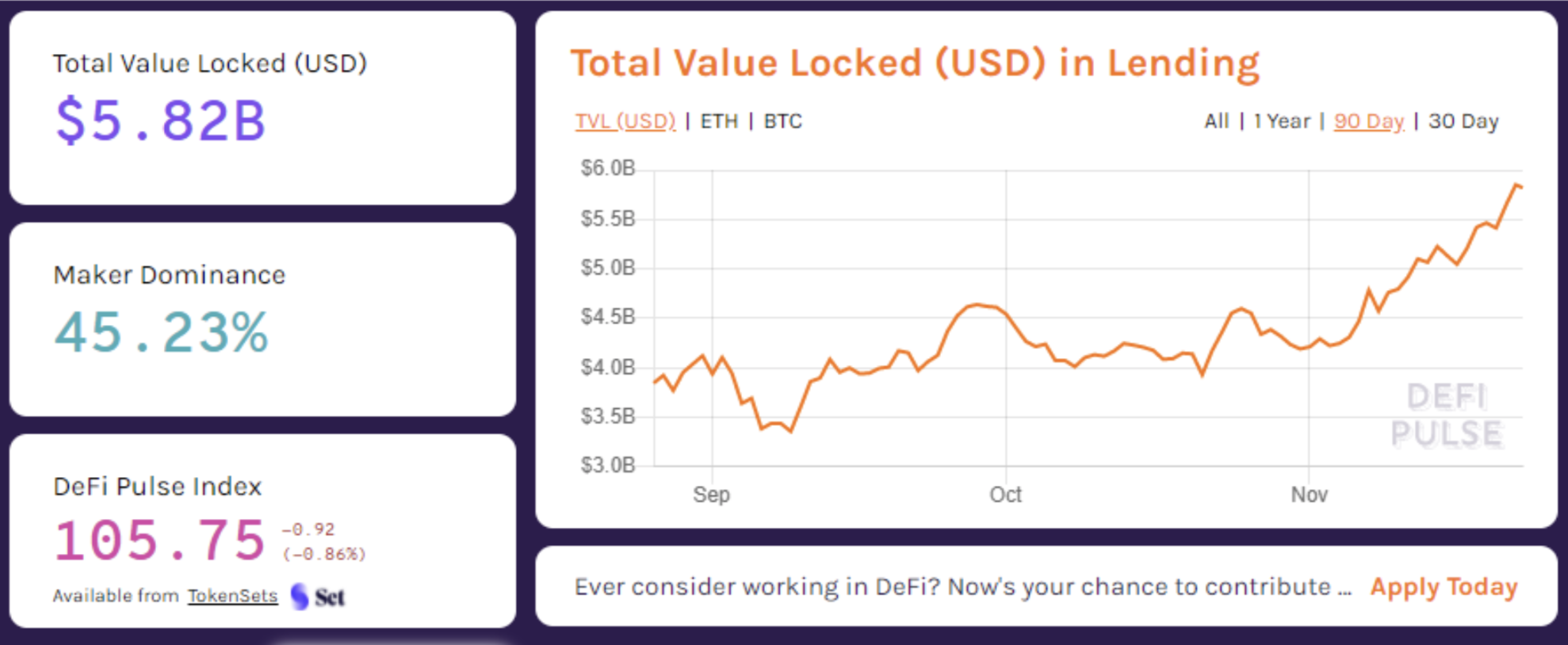

The possibility of carrying out loans in cryptos without an intermediary is the historical use case at the origin of the spread of decentralised finance. The three most popular dapps in this segment (Compound, Maker and Aave) alone account for more than a third of the value deposited on the DeFi.

The working principle of these platforms is simple, it consists in allowing lenders to deposit cryptos on the smart contracts of the protocol against payment in order to make them available to borrowers.

To guarantee the borrower’s solvency, the borrower must deposit as collateral a sum in cryptos at least equivalent to the amount borrowed.

For the borrower, the transaction makes it possible to obtain liquidity without having to sell off the collateralised asset which he can recover after repayment, similar to a mortgage loan; it can also be part of a trading strategy aimed at betting long or short on the collateralised asset or on the borrowed asset.

In exchange for depositing their savings in cryptos on the application, the lenders receive interest (#2 🌳 Interest) but also, on certain applications, governance tokens that can be valued on the market and allow them to participate in the governance of the project (#3 👨🌾 Liquidity mining).

This activity raises several questions relating to the regulations applicable to funding operations on crypto, the liability of the developers of these projects and the tax treatment of loans.

The regulatory framework for financing operations using cryptos

In terms of financial regulation, the activity of lending cryptos seems a priori to be excluded from the scope of the banking monopoly, which applies only to the granting and receipt of funds understood as banknotes, coins, scriptural money or electronic money, even if some stablecoins may however fall within the scope of the latter notion (#5 ⚖️ The stablecoins).

To date, the main regulatory risk for decentralised lending applications remains the draft European MiCA (Markets in Crypto-Assets Regulation) published by the European Commission on 24 September 2020.

Although it does not specifically target DeFi applications, the draft provides that the admission of stablecoins can only be legal after obtaining an approval, the conditions for granting which appear to be largely incompatible with the operation of existing applications. As a result of the contagion effect, and following the example of the STABLE project (Stablecoin Tethering and Bank Licensing Enforcement Act) in the United States, the European stablecoin framework is likely to impose an extremely strong regulatory constraint on the entire DeFi, and lending applications in particular.

Proposition de RÈGLEMENT DU PARLEMENT EUROPÉEN ET DU CONSEIL sur les marchés de crypto-actifs, et modifiant la directive

(UE) 2019/1937

The responsibility of lending application developers

Although they are still confidential, decentralised lending applications pose real risks to their users: fraud, bugs in smart contracts or loss of capital.

While the decentralised and open source nature of these applications is an additional obstacle to legal action against those responsible, it does not guarantee them legal irresponsibility.

Once there is a strong political will to regulate the sector or a coordinated action by aggrieved users seeking to engage the criminal or civil liability of those responsible for an application, its decentralised nature cannot have the effect of conferring legal immunity on the project’s developers or main contributors.

In this respect, the recent legal action taken in the United States by users of the Maker protocol following the liquidation of their collateral during Black thursday on 12 March 2020 is particularly significant. The content of the class action focuses in particular on a deliberately underestimated representation of financial risk by the creators of the application.

Indeed, the availability to the public of an application that does not comply with the regulatory framework, has defective security or presents a risk of loss poorly presented to users could justify the multiplication of this type of legal recourse (contractual, tort or criminal liability) against developers as soon as the latter are identifiable, which is often the case (notably on Github), despite the decentralised nature of the protocol.

To limit the implications of the occurrence of this risk, several measures can be implemented by the main contributors of a Dapp in order to protect themselves while limiting the inherent decentralised and open source dimension. These include, in particular, the following:

- the use of an open source license;

- the drafting of terms of use for the application in order to limit the risks of infringement to consumer law;

- the creation of a legal entity (company, cooperative, foundation) in order to avoid the project managers committing their personal assets in the event of an action brought against the protocol.

Taxation of loans

If the legal liability is diffuse, each user is personally responsible for complying with his or her tax obligations.

Interest received by lenders constitutes income that should be taxed under the conditions discussed later (#2 🌳 Interest). But the mere fact of borrowing cryptos by depositing other cryptos as collateral could also give rise to taxation in the event of liquidation of the collateral and use of the borrowed cryptos.

On the one hand, the transaction raises the question of whether borrowing with collateral is likely to constitute a taxable event. The question remains open, but a literal application of tax law should in most cases lead to consider that loans do not constitute a taxable event.

While it is legitimate to question the existence of a taxable event due to the transfer of ownership resulting from cryptos loans, a reasonable analysis should lead to consider that the loan does not give rise to a taxable event insofar as the digital assets are effectively returned. Otherwise, and in particular in case of restitution of value – whether in legal tender or in another digital asset – the loan of cryptos would become an exchange of an onerous nature and would constitute a taxable event.

Thus, if the mere fact of taking out a cryptos loan secured by the deposit of collateral would not as such give rise to taxation, the liquidation of the collateral would have to characterise an exchange that could constitute a taxable event. In France, exchanges between cryptos have no tax consequences for individuals. But it would be different if the loan was made in legal tender, as already proposed by many centralised platforms.

Example: I deposit 3 ETH for a total amount of €1,500. I borrow €750 with a collateralisation rate of 50%. Later, the ETH rate collapses and my 3 ETHs are sold for €750. It is therefore to be considered that a taxable sale took place on the day of the liquidation of my ETHs deposited as collateral. The following year, I will therefore have to declare this transfer which will trigger the taxation of a fraction of my portfolio.

On the other hand, the tax treatment of cryptos that may be borrowed also poses difficulties.

Indeed, in France, capital gains realised on a crypto-fiat disposal must be calculated by reference to the unrealised capital gain on the overall portfolio. All cryptos “owned” by the taxpayer must be included in the value of this portfolio. In the event of a loan, the cryptos borrowed will increase the taxpayer’s portfolio, reduce proportionally the fraction of the total acquisition price deductible from the transfer price and, consequently, increase the taxable capital gain in the event of a taxable transfer.

Thus, the economic logic should lead to not include in the overall value of the portfolio, for the calculation of the taxable capital gains, the value of the borrowed digital assets which, if they are held by the taxpayer, are not his property.

Example: I bought 30 ETH for €150 each and 2 BTC for €3,000 each. The total acquisition price of my portfolio is therefore €10,500. Later, the BTC is €15,000 and the ETH is €500. I decide to collateralise my 30 ETH to borrow 7,500 DAI (by simplification, 1 DAI = €1). I then pay 6,000 DAI in payment of my lawyer’s fees.

This payment constitutes a taxable transfer. The formula for calculating the capital gain is as follows: Sale price – Total acquisition price of the portfolio x Sale price / Total value of the portfolio.

If the collateralized and borrowed cryptos are included in the value of the portfolio, the taxable capital gain is equal to €4,800 (6,000 – 10,500 x 6,000 / 52,500).

If the borrowed cryptos are not included in the value of the portfolio, the taxable capital gain is equal to €4,600 (6,000 – 10,500 x 6,000 / 45,000).