NFTs are everything but art!

Following the breathtaking auction of Beeple’s “Everydays: The First 5,000 days” for nearly $70 million, the art world has been quick to adopt NFTs.

Non-fungible tokens are a technical tool that opens up an impressive number of new online uses by creating digital scarcity in a world previously dominated by copy-paste. They make it possible to improve existing processes for authenticating and/or tracing physical objects. But above all, they allow the authentication of purely digital files (image, video, text, etc.) by making them unique.

This property makes it possible to offer the authenticity, rarity and originality characteristic of art to purely and exclusively digital works, thereby revitalising the digital art sector and disrupting the art market organisation by creating a more direct link between artists and collectors.

It is therefore not surprising that the art world has so quickly embraced this new opportunity.

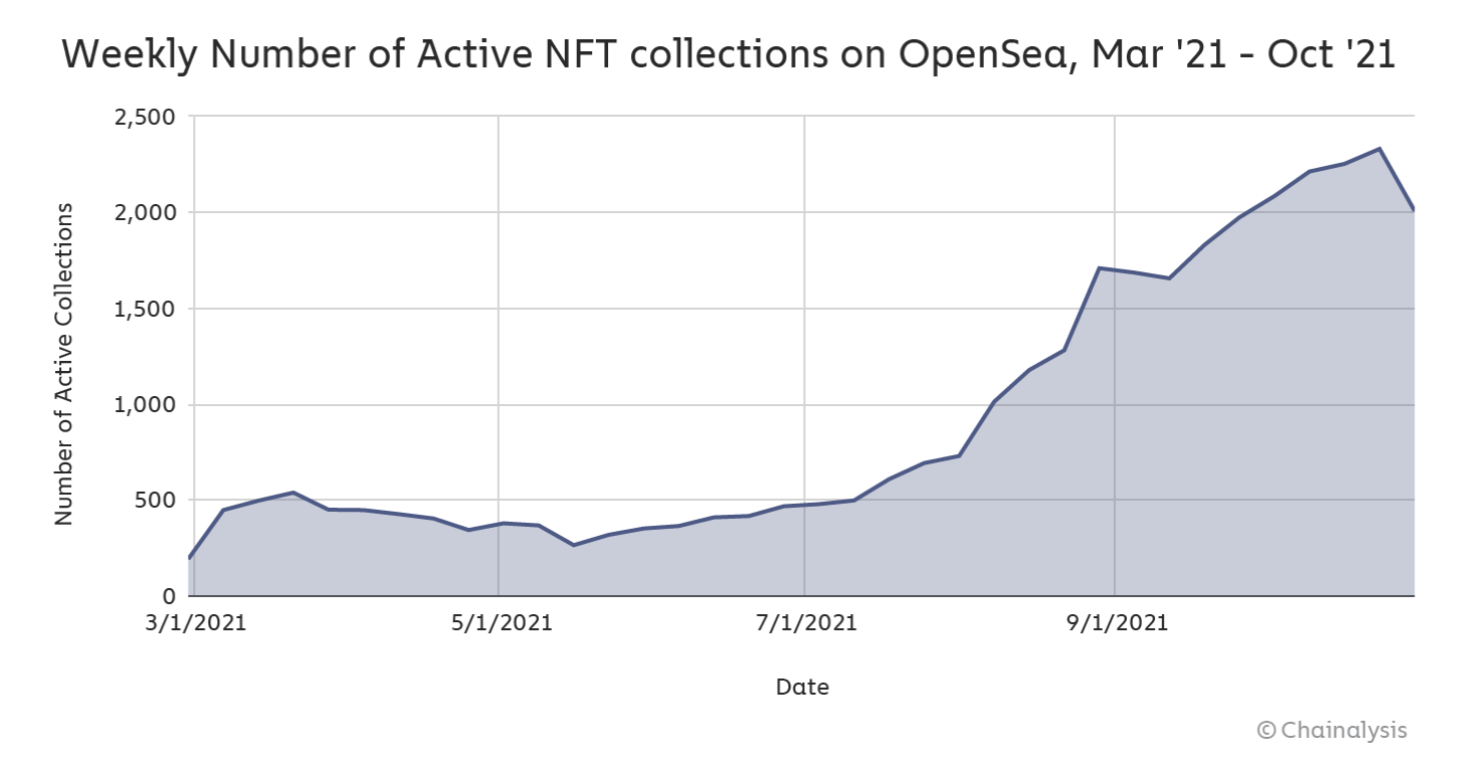

Given the significant explosion in the value of a number of collections, the question of the taxation of NFTs quickly arose.

Contrary to what is often said, if the French tax regime of NFTs remains somewhat uncertain today, NFTs representing digital artworks cannot – unfortunately – be classified as artworks for tax purposes.

Why do we often read that NFTs benefit from the work of art tax regime?

The assimilation of a certain number of NFTs to works of art is quite natural and proceeds from two intuitive reflexes.

The first reflex occurs when one sees the work. Many of these NFTs are indeed the result of work that can undeniably be described as artistic. The digital works they authenticate are the result of a real creative process.

The second reflex occurs at the sight of the tax rates likely to apply to the capital gain on the transfer of the piece. Indeed, works of art benefit from a series of privileged tax arrangements.

Firstly, individuals and companies selling works of art on a non-professional basis can choose between taxing the transfer price (sale price) at a particularly favourable rate of 6.5% or taxing the capital gain (sale price – purchase price) at 36.2%.

Secondly, companies acquiring works of art for public display are entitled to deduct the acquisition value of these works from their taxable income over five years up to a limit of €20,000 or, if this amount is higher, up to 0.5% of their turnover per year. This scheme allows part of the acquisition to be funded by reducing corporate income tax by 25% of the value of the work.

Finally, transactions involving works of art benefit from a reduced VAT rate of 5.5% instead of the standard rate of 20%.

While the artistic nature of digital works authenticated by NFTs is not in question, it should only be noted that the purely digital nature of these works prevents them from being qualified – from a tax point of view, of course – as works of art and from benefiting from the regimes set out.

Why can’t NFTs be classified as works of art for tax purposes ?

Indeed, the artistic quality of a work is not sufficient to confer on it the quality of a work of art for tax purposes.

The notion of work of art is defined by reference to a restrictive list of artistic works. It includes, in particular, original engravings printed in limited numbers and executed by hand by the artist, sculptures executed entirely by the artist and castings printed in limited numbers, photographs taken by the artist and printed by him or under his control, etc.

In addition to these works, which obviously do not include digital works, the tax notion of work of art also includes “paintings, collages […] paintings and drawings, executed entirely by hand by the artist“.

Although digital works could, in common language, meet the definition of drawings, the text expressly states that they must be executed “by hand by the artist“. This is why the tax authorities specify that this criterion excludes “the use of any process whatsoever that makes it possible to replace, in whole or in part, this human intervention” (BOI-TVA-SECT-90-10), including the use of a mouse…

This is what the Minister of Culture said in an answer dated 12 January 2021 to a parliamentary question n° 22584 asked on 3 September 2019, after having considered that “a change is desirable“, while specifying that this change could only take place at the level of European Union law.

While this textual obstacle is regrettable and may seem unfair or even outdated, the rise of NFTs could reopen the debate on the inclusion of digital works in the tax category of works of art. By making it possible to authenticate the owner of digital goods, NFTs allow the rarity of original works of art to be created and thus delimit the scope of application of particularly generous tax regimes. Currently, the taxation of NFTs does not benefit from any preferential regime.

What is the taxation of NFTs representing digital works?

The tax treatment of artistic NFTs depends on the nature of the transactions and the status of the taxpayers involved.

Taxation of NFTs for artists

For artists issuing digital works authenticated by NFTs, the impossibility of benefiting from the tax classification of works of art has several consequences.

Regarding income tax, the classification has no impact, as the proceeds of sales remain subject to non-commercial profits.

Regarding VAT, the artist cannot benefit from the reduced rate of 5.5%. His sales should therefore be subject to the 20% rate. However, he may benefit from a reduced rate of 10% on sales of works that meet the following two conditions:

- they are executed in a single copy or in a limited number, individualised by the author’s signature and numbered; as there is no requirement as to the physical nature of the work, NFTs should be able to satisfy, for the first time in a digital context, the condition of scarcity and individualisation of the work;

- they denote the author’s intention to execute a work which has an exclusively artistic function and which is original, i.e. which reflects the author’s personality; in this respect, generative art could pose some difficulties but should, in our opinion, be considered a work of the mind insofar as, although the work is ultimately generated by an algorithm, the elements making it up are the result of the personal and intellectual contribution of their authors.

Regarding social security contributions, creators of works that can be qualified as creative works within the meaning of the above can be affiliated to the artist-author scheme and benefit from considerably reduced social security contributions.

Taxation of NFTs for collectors

For collectors, while it is certain that they cannot benefit from taxation at the very advantageous rate of 6.5%, the modalities of taxation are uncertain. These depend on the legal classification of the work authenticated by an NFT.

If the NFTs can be classified as digital assets, the transfers will fall under the regime of capital gains on digital assets. The regime is advantageous because, while it provides for an overall tax rate of 30%, exchanges between digital assets are not taxed. The purchase or sale of the NFT in cryptos does not therefore generate any taxation, which only occurs in the event of a sale in legal tender. However, the question arises as to how to value the NFTs in the portfolio.

However, it is more likely that NFTs cannot be classified as digital assets. Tax law is a realistic and relatively neutral law. The tax characterisation of the transaction should therefore focus on the nature of the asset sold rather than its medium. No one questions the tax status of certificates of authenticity, only the tax status of the work they authenticate matters. The same applies to digital works, whether or not they are certified by NFTs. Under these conditions, it seems fairly obvious that these works cannot, in themselves, be classified as digital assets.

Thus, only the system of capital gains on movable property should be applicable. This regime provides for an overall taxation of the capital gain at the rate of 36.2%, the capital gain having to be declared and the tax paid in the month following the transfer. Under this regime, only capital gains executed on sales of more than €5,000 are taxable (a capital gain of €4,000 on an NFT sold for €4,500 is therefore exempt). In addition, an allowance for the length of the holding period is provided for.

On the other hand, since artistic NFTs cannot be qualified as digital assets, crypto-NFT exchanges are likely to generate taxation (e.g. the purchase of an NFT in ETH constitutes a taxable transfer of ETH).

Taxation of NFTs for marketplaces

For NFT marketplaces, taxation depends largely on the contractual scheme adopted (commission, interposition, etc.).

It should be noted that, unlike authors, they cannot benefit from the reduced VAT rate of 10% and must therefore apply the standard rate of 20%. However, the VAT territoriality rules make it possible to limit the VAT impact in certain cases. On the other hand, the status of marketplace implies compliance with a certain number of additional obligations (annual reporting to the tax authorities on transactions executed by users, solidarity in VAT matters, etc.).

Besides the tax aspects, the impossibility of classifying an NFT as a work of art and digital assets is of great interest to platforms: it prevents them from falling within the scope of anti-money laundering obligations and allows them to avoid bearing the heavy burden of controlling and verifying the identity and origin of the funds of their customers…

Given the complexity of the different regimes, it is clear that NFTs are not only shaking up the art world but also the tax system, which will have to adapt to better deal with a new category of purely digital assets and, in the best of all possible worlds, encourage their development in France.

ORWL Avocats is at your disposal to help you legally qualify your NFTs and fiscally structure your activities.