NFTs and Play-to-Earn: how to reach legal compliance ?

In the rise of the “Play-to-Earn” games, crypto-assets open a range of new perspectives.

The Play-to-Earn business model allows gamers to be rewarded in return for playing online. Thanks to Blockchain-based technologies, gamers are rewarded with tokens, whether fungible or not (utility tokens or non-fungible tokens – NFT). Most P2E games allow gamers to win utility tokens’ rewards and buy NFTs representing characters, perks, or in-game weapons.

Those digital objects have major silver linings :

- 📜 Each user can benefit from an irrevocable property right on the tokens they own, and each user can donate or resell their tokens independently from the game editor;

- 💰 They have a real-world economic value, generally via an NFT marketplace (OpenSea, Solanart, etc.) or a crypto-currencies exchange such as Coinbase, Bitstamp or Binance;

- 🌍 They are supported by all the underlying Blockchain-based ecosystem of applications: wallet, exchange service, artistic app or even other games.

For instance, Axie infinities, a popular game similar to Pokemon, allows its users to:

- buy or raise the game’s creatures in the form of NFTs;

- win tokens by playing (more specifically, by winning battles between NFT-characters);

- sell or buy NFTs on the game’s marketplace and sell or buy tokens on a crypto-currencies exchange.

This game witnessed astonishing success with more than 2 million users, while the AXS token grew up to… 16.000% this year !

However, despite these characteristics that offer endless possibilities, these digital objects could be subjected to regulations related to digital assets services and/or to gambling and quite complex taxation.

Play-to-Earn what? Are NFTs and tokens digital assets ?

The digital assets legal classification

The qualification of tokens (fungible or not) as digital assets is a major question for this nascent industry. Under these qualifications, their purchase using legal tenders or cryptocurrencies would represent a service that could fall within the scope of the regulations applicable to token issuers or digital assets services providers (DASP).

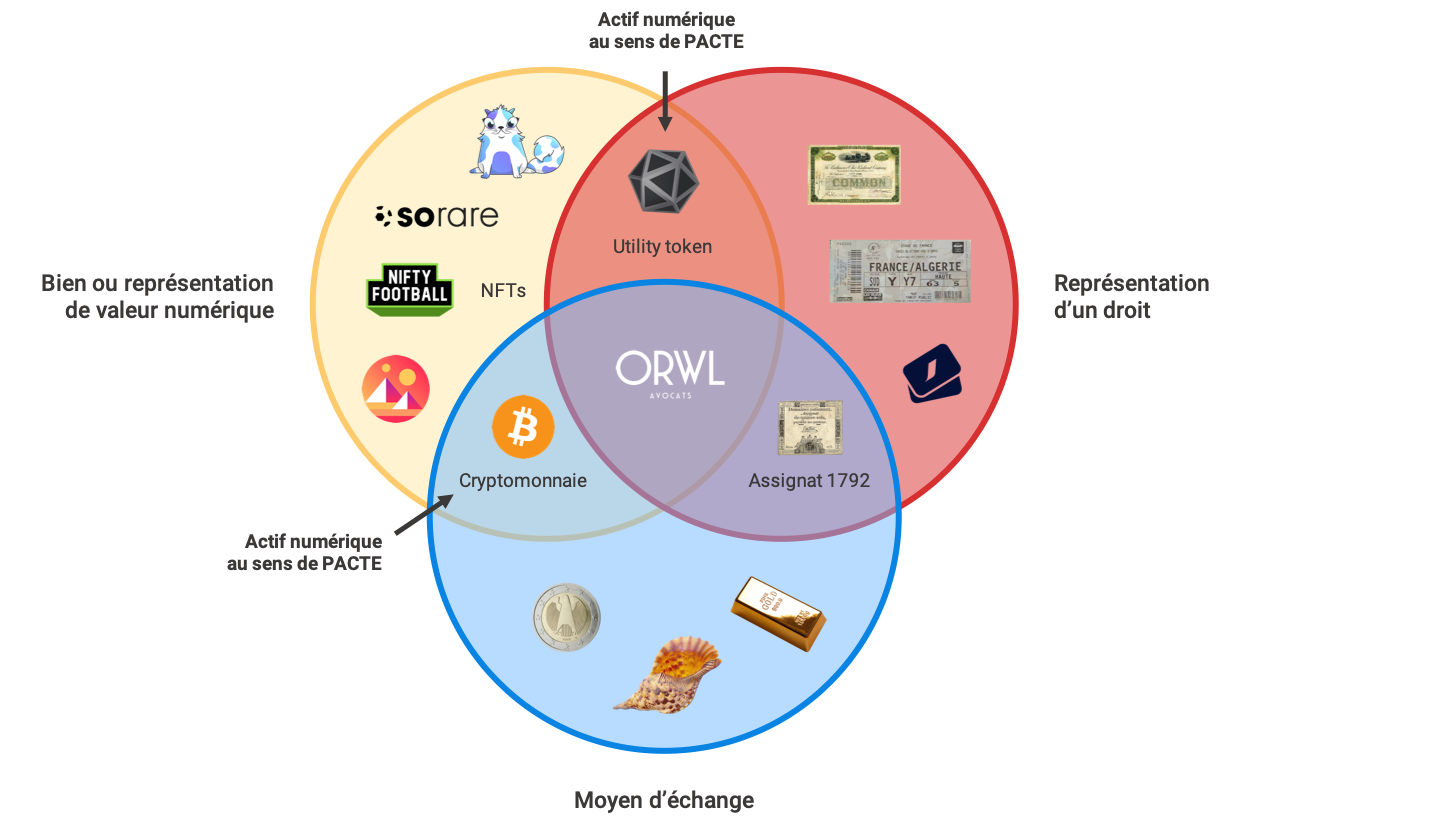

Tokens, and NFTs especially, must be analyzed in regard to the digital asset notion set forth by the French Monetary and Financial Code that cover both utility tokens and virtual currencies.

What is a utility token? A token can be defined as a digital property issued on a Blockchain that gives access to a good or service the issuer provides. A token generally embodies a voting right or access to an online service, such as the BATs (Brave rewards) from the browser Brave or the Filecoins from the eponymous service.

Therefore, classifying a digital object as a token depends on the characteristics and the rights attached to the concerned digital object, involving a case-by-case analysis.

If utility tokens in Play-to-Earn games logically fall within the legal token classification, the NFT classification is more complex. Indeed, it usually grants a property right to its owner. Exclusively attached to the instrument, it doesn’t give any right of access to a service, allowing to exclude the token classification.

What is virtual currency? The main characteristic of a virtual currency is its ability to be used as a means of exchange, e.g. ethers, bitcoins or sol.

While an NFT is, by essence, unique, rare and non-interchangeable, a fungible token allowing to acquire NFTs appears to be a means of exchange.

Accordingly, while NFTs don’t qualify as virtual currencies, fungible tokens may fall under the scope of this notion.

The application of the DASP legal regime

Depending on their characteristics, fungible tokens or NFTs available through Play-to-Earn games could be qualified as digital assets.

This could result in many consequences linked to:

- the French legal regime of tokens’ issuance, if the gaming platform issues tokens that fall under the notion of digital asset;

- the DASP regulation, if the gaming platform:

- allows the purchase of tokens in fiat-currency or crypto-currencies, additionally to the ability to freely allocate them;

- provides a storage (wallet) service linked to the gamer’s account that is supporting the token; or

- connects sellers and buyers through an exchange platform.

Legal regime application also depends on whether independent third parties provide the services mentioned above. For instance, there is no direct digital assets service when the gamer is connected to a third-party exchange platform to acquire tokens.

Play-to-Earn how? Gambling and game of chance risk for Play-to-Earn service

Play-to-Earn games also run the risk of falling under the scope of the regulation related to gambling and games of chance, which are activities subject to the grant of accreditation.

Without this license, gaming activity would be considered illegal and heavily sanctioned.

Three criteria must be met to qualify an activity of gambling and games of chance:

- Reaching out to the public; the mere fact of reaching out to a larger circle than a private and restricted one (family, friends) – including on the Internet – is enough to qualify as a public offer, within the meaning of prohibited lottery legal regime;

- Offering an expected gain due to pure luck: this criterion involves

- (i) a probability for the customer to gain an economic profit i.e., an object that “could result in a monetization, thus being sold”,according to the ARJEL (the French online gambling regulatory authority), and

- (ii) a profit’s lying in the hazard, even partially. Thus, the NFT won in-game composition can be random, particularly in loot boxes. Generally, this hazard is a crucial component of the opportunity to make a profit, depending on the chance to discover an NFT more or less rare;

- Involving a financial sacrifice; this criterion is not evident in a P2E model. Indeed, most games are free and tokens may be won while playing. However, providers must pay particular attention to the sale of elements (bonus, upgrades, etc.) that allow gamers to improve their NFTs avatars since they may characterize a financial sacrifice from the concerned gamer;

The ARJEL position regarding loot boxes has confirmed this analysis. It considers that a loot box containing elements that may be monetized can qualify as gambling if it’s being purchased and if “the loot can be transferred outside of the gaming platform and if the provider allows gamers to use loots purchased outside of the environment of his platform”.

Play-to-Earn it all? The tax consequences

The taxation of the issuers (usually the editor of the game) mainly depends on the classification of the NFT. In theory, it qualifies as a movable asset because there is no right on the issuer, unlike for a utility token.

For taxation, some crucial factors must catch the attention of users and providers.

The VAT application to Play-to-Earn model

Suppose the question of the application of the VAT to digital assets operations is, to a certain extent, resolved. In that case, it’s somewhat different for NFTs since they generally don’t fall within this definition. The sale of NFTs, just as any other goods or services, may be subject to VAT when not expressly exempted. Indeed, all services provided for consideration fall in the scope of the VAT when there is a direct link between the services (e.g. the delivery of an NFT) and the consideration received (e.g. an ETH payment).

As a rule, the VAT applies to all Business-to-Consumer transactions made by a French provider, regardless of the user’s place of establishment. However, some specific legal regimes – subject to conditions – allow applying the VAT of the user’s residence, which can be a crucial advantage when a significant part of the users base is located outside of France.

This point is more important as the 20% VAT standard rate may significantly reduce the provider’s income. In some situations, the VAT rate can be reduced to 10% when NFTs display some level of originality. By contrast, NFTs can never qualify as artworks regarding the tax law (excluding the favourable 5.5% rate), as opposed to what can be seen in some writings.

Therefore, it’s crucial to define the VAT regime beforehand to benefit from the small levers provided by the law in this matter (territoriality and rate).

Income tax

The sale of an NFT will constitute the tax result of a company if it’s sold in a condition that doesn’t allow the buyer to expect any complimentary services. Generally, an NFT is not linked to a service, meaning that its sale must be considered an operating income at the sale’ date.

When the NFT is linked with some rights, it will qualify as a token within the meaning of the French Monetary and Financial Code, and the VAT and corporate tax payment may be deferred, subject to conditions.

In any case, the initial creation of a structure subject to corporate tax seems essential to avoid higher taxation through individual income tax and an extension of the tax administration inspection period up to 10 years based on the “hidden activity” regime.

The law firm ORWL Avocats is available for more information and to assess the compliance of your P2E project.